Energy-Efficient Homes and UK Property Value (2024)

Energy efficiency is playing an increasingly pivotal role in the UK housing market, influencing both property values and rental income. As the government tightens regulations and homebuyers and tenants become more environmentally conscious, energy efficiency is no longer just a secondary factor but a significant driver in property valuation. This article explores how energy-efficient housing impacts house prices and rental values in the UK, and examines how future trends, including global and domestic policies, will shape the real estate market in the coming years.

The Rise of Energy Efficiency in the UK Housing Market

Historically, energy efficiency was not a top priority for homeowners or landlords in the UK. Factors like location, property size, and aesthetic appeal dominated house prices and rental rates. However, in the past two decades, the emphasis on energy-efficient homes has grown significantly, driven by rising energy costs, government policy changes, and increasing awareness of environmental issues.

One of the most significant shifts came in 2007 with the introduction of Energy Performance Certificates (EPCs) under the EU’s Energy Performance of Buildings Directive. These certificates provide a clear energy efficiency rating for properties, from A (most efficient) to G (least efficient), allowing prospective buyers and tenants to factor in energy costs when assessing a home. Since then, energy efficiency has increasingly influenced home valuation in both the sales and rental markets. Many organisations such as Energy Efficiency Infrastructure Group are pushing for strong reform.

The Impact of Energy Efficiency on UK Housing Valuations: Insight for Buyers and Investors

Numerous studies show a strong correlation between energy efficiency and house prices in the UK.

Department for Business, Energy & Industrial Strategy (2020). “Impact of Energy Efficiency on Property Values”.

According to a 2020 report by the UK Department for Business, Energy & Industrial Strategy (BEIS), properties with higher EPC ratings (A or B) sold for up to 14% more than those with lower ratings (D or below). This price premium can be explained by several factors:

- Lower Energy Bills: More energy-efficient homes require less energy for heating, lighting, and other utilities, which translates to long-term savings for homeowners.

- Increased Comfort: Energy-efficient properties often offer better insulation and more consistent temperatures, enhancing the living environment.

- Market Demand: As consumers become more conscious of climate change and energy costs, properties with strong energy efficiency credentials are in higher demand.

- Future-Proofing: Energy-efficient homes are seen as less vulnerable to future regulations and rising energy prices, making them more attractive investments.

Although the report is out dated by a few years, it is reasonable to expect that the underlying trends continue today, even if the percentage premiums may differ. Importantly, the report emphasises that as energy costs rise and energy efficiency regulations become stricter, homes with higher EPC ratings are likely to experience stronger long-term appreciation. The growing demand for sustainable housing is expected to surpass supply, resulting in greater value growth for energy-efficient properties compared to less efficient ones. This might suggest a great premium difference.

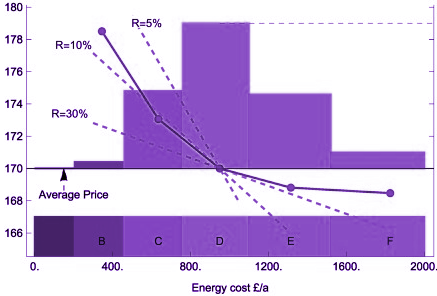

Department of Energy & Climate Change (2013). “Hedonic Pricing Study”

A 2013 study by the Department of Energy & Climate Change (DECC) further highlights this trend. It found that homes with an EPC rating of A or B sold for an average of 14% more than properties with a G rating. Properties rated C sold for about 10% more, and even those with a D rating saw a 8% price premium compared to the least energy-efficient homes. This indicates that as energy efficiency improves, property values increase, making it a vital consideration for both homeowners and landlords.

Table 1: Property Price Premium Based on EPC Ratings (DECC 2013 Study)

| EPC Rating | Price Premium Over G-Rated Homes |

| A/B | 14% |

| C | 10% |

| D | 8% |

| E | 6% |

| F | 4% |

Are There Limits to the Energy Efficiency Premium?

While energy efficiency offers a clear opportunity to increase rental income, it is important to recognise that there may be limits to how much landlords can raise rents, even for highly energy-efficient properties. The rental market in the UK, particularly in urban areas like London, Manchester, and Birmingham, has already reached a point where many tenants are paying as much as they can afford. In some regions, rental prices are growing faster than wages, which could limit the scope for further increases, even for energy-efficient homes.

Moreover, housing affordability remains a significant issue. While tenants may prefer energy-efficient properties to save on energy bills, their overall budget constraints could limit how much extra they are willing or able to pay in rent. Therefore, landlords must balance the value added by energy efficiency with the broader economic context when setting rents.

Similarly, the premium attached to energy-efficient homes in terms of sales prices may also face limits. Despite the clear benefits of lower running costs, buyers still have to contend with broader housing market trends, such as regional affordability constraints and rising interest rates, which may curb their ability to pay more for energy-efficient properties. Even as energy efficiency becomes more important to buyers, house prices are ultimately capped by what buyers can finance and afford in the wider market.

UK Government’s Push for EPC Rating C: Changing Policies to watch.

The government’s commitment to improving energy efficiency in homes is accelerating. In a major positive development for both tenants and landlords, the UK government announced on 23rd September 2023 that it will consult on proposals to ensure private and social rented homes achieve an EPC rating of C or equivalent by 2030. This consultation forms part of the broader initiative to support the UK’s legally binding goal of achieving net-zero carbon emissions by 2050. Upgrading properties to meet this standard will not only ensure compliance with future regulations but also unlock multiple benefits for property owners and renters alike. Much is outlined in “Minimum Energy Efficiency Standards” (MEES)

By focusing on boosting energy performance, the government aims to reduce energy consumption, lower bills, and create warmer, more comfortable homes. The planned changes, which are part of the UK’s “Home Upgrade Revolution,” will particularly benefit renters by making housing more affordable and reducing exposure to energy price fluctuations. For landlords, it presents an opportunity to improve property value and rental yield, as more energy-efficient homes continue to demand a premium in both the sale and rental markets.

Government Targets for Energy Efficiency Improvements

| Policy/Target | Details |

| EPC Rating C for Private and Social Rented Homes by 2030 | Government consultation announced September 2023 |

| Fuel Poverty Target (EPC C for Fuel-Poor Homes by 2030) | Addressing high energy costs and poor housing conditions |

| Net Zero Emissions by 2050 | Requires significant reduction in home emissions |

| Clean Growth Strategy (EPC C for All Homes by 2035) | Promotes demand for energy efficiency products and services |

Energy Efficiency Trends Shaping the Future for UK Landlords

The growing focus on energy efficiency in the housing market is expected to intensify in the coming years. Government regulations will continue to tighten, pushing for higher EPC standards, and the drive towards net-zero emissions by 2050. This is mirrored by industry organisations such as, RICS who In March 2024 introduced the Residential Retrofit Standard, aimed at improving the quality of energy-efficiency upgrades in homes across the UK.

“A series of extra questions were included in the RICS Residential Property Monitor in January, to gauge the impact of energy efficient properties on market trends, which made for some interesting and insightful responses… 43% stated that sellers were looking to attach a premium to homes that are more energy efficient. 26% reported seeing buyers highlight poor energy efficiency as a reason for making an offer below asking price and 37% said that higher energy efficient homes were holding their value in the current market.”

International trends suggest that energy-efficient homes will command even higher price premiums in the future. A report by McKinsey & Company in 2019 predicted that homes with strong energy efficiency credentials could command price premiums of up to 30% by 2030, as global efforts to decarbonise intensify.

For UK landlords, this presents both challenges and opportunities. Investing in energy-efficient upgrades will be necessary to comply with future regulations, but it will also provide long-term financial rewards through higher rental income and increased property values. Whilst empirical data is limited the markers are clear and landlords and homeowners who fail to upgrade their properties may find themselves unable to rent them out or facing a relative drop in their market value.

Exemplary Energy-Efficient Homes: A key Indicator for the Market

The most stringent energy standard is the Passive House (Passivhaus) standard, with its retrofit equivalent, EnerPHit. These standards are designed to drastically reduce energy consumption by ensuring superior insulation, airtightness, and mechanical ventilation with heat recovery up to 90%. As society moves towards greater sustainability, it is wise to examine trends in the most advanced energy-efficient housing. A growing body of evidence suggests that homes built or retrofitted to Passive House and EnerPHit standards can command significant price premiums.

A study conducted by the Passive House Institute revealed that certified Passive Houses could fetch 5–10% more in market value compared to conventional homes due to their ultra-low energy bills, enhanced comfort, and superior air quality. Similarly, the EnerPHit standard, which applies Passive House principles to retrofit projects, has shown similar premiums, especially as demand for sustainable, future-proofed properties increases.

Research by the London School of Economics (LSE), Grantham Research Institute also found that highly energy-efficient homes, including Passive House and similar standards, can expect greater long-term appreciation rates due to rising energy costs and stricter regulations on energy performance in buildings. The reduced operational costs and resilience to future energy price hikes make these properties highly desirable, particularly among environmentally conscious buyers and investors seeking future-proof assets. It is always important that current relationships between energy efficiency and property premiums are used as indicators of future correlations and trends. Appreciation in house value is arguably more important than initial price premiums, as energy-efficient homes are likely to gain more value over time, making them even more attractive investments.

Conclusion: Why Energy Efficiency is a Crucial Consideration in UK Property Value

In conclusion, energy efficiency is becoming an increasingly important factor in the UK housing market, influencing both house prices and rental values. Properties with higher EPC ratings historically are commanding significant price premiums and attracting higher rental rates as tenants and buyers prioritise energy savings and environmental sustainability.

For landlords, investing in energy-efficient upgrades is not only a way to increase property and rental value but also a crucial step towards future-proofing their investments. As government regulations tighten and demand for sustainable homes continues to grow, energy efficiency will play an even greater role in the property market in the years to come.

By aligning with the UK’s broader policy objectives of reducing emissions, tackling fuel poverty, and supporting economic growth through innovation and job creation, landlords can help shape a more sustainable future while maximising their returns.

From Caution to Confidence: Strategies for Unlocking Value in Energy-Efficient Properties

Investors and homeowners often instinctively focus on worst-case scenarios, which can lead to overestimating the costs of energy-efficient upgrades while underestimating the potential benefits. This cautious approach, while understandable, can cause them to amplify the perceived financial outlay and diminish the value of long-term gains, such as increased property values, higher rental incomes, and lower energy bills for tenants. This is especially the case when current strategies are already profitable, leading investors to be more resistant to change. However, to make decision-making more tangible and data-driven, consulting with a sustainability expert such as Resolve can provide detailed, numeric insights into potential costs and returns. Resolve can quantify these variables, offering data on payback periods, energy savings, and market value increases, helping investors move beyond instinct and make informed, strategic decisions that align with future market trends and regulations.

It must be noted that the factors contributing to profitability in energy-efficient homes are wide-ranging and variable. Just to name a few, these include energy costs, the state of the housing market, government incentives and subsidies, as well as labour and material costs. All of these elements play a significant role in determining the overall return on investment for energy-efficient upgrades, and each can fluctuate over time, impacting profitability in different ways. These variables can be compared with a solid reliable energy model, built specifically for your project by Resolve Sustainability Consulting.